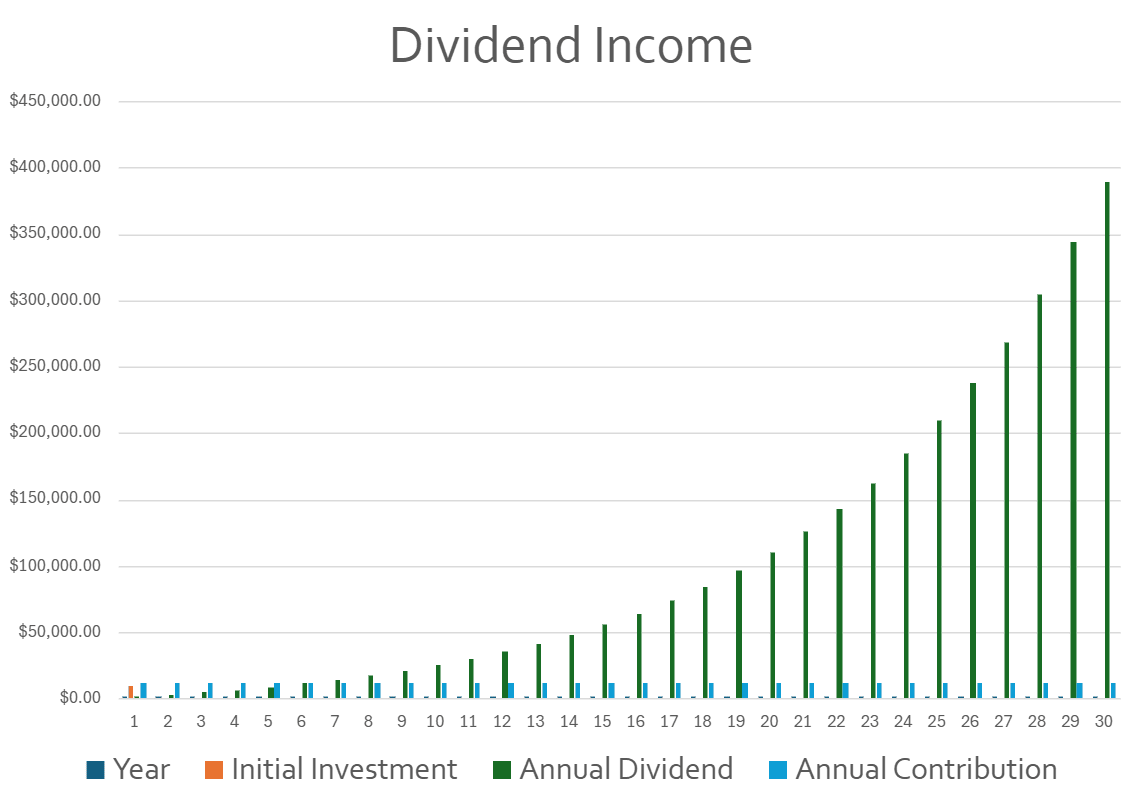

As you can see from the chart above, if you start with a ten thousand dollar initial investment and contribute one thousand dollars a month, compounding at 12%, after 30 years, you will have a dividend income of over $380,000 a year. You can make this your reality by subscribing to Fly High Investing.

Click the button below to chart your course to financial freedom if you subscribe to Fly High Investing.

Investing in dividend stocks offers distinct advantages over other forms of investing. Here are some of these benefits:

Monetizing vs Cannibalizing: Dividend stocks monetize your portfolio, providing a steady income stream without selling off your investments. If your stocks don't pay dividends, you are forced to cannibalize your portfolio to generate cash flow, depleting your assets.

Diversification: Portfolios focused on dividends typically encompass stocks spanning diverse industries and sectors, enhancing diversification and providing a dependable source of passive income.

Long-Term Perspective: Dividend income investing encourages investors to focus on the income generated by dividends and less on short-term market fluctuations, as market volatility does not affect dividends.

Reinvestment: Dividends can be reinvested to purchase more shares of dividend-paying stocks. Over time this process, known as compounding, will result in exponential growth of your passive income stream.

Inflation Hedge: Dividend payments act as a hedge against inflation. helping to offset the erosion of purchasing power caused by inflation.

Psychological Comfort: The steady income from dividends provides psychological comfort and reduces the temptation to make impulsive investment decisions during market volatility.

Lower Volatility: Since stock market volatility does not impact companies' ability to pay dividends, dividend income tends to be significantly more stable than the fluctuations of the stock market.

Financial Freedom: Compounding dividends exponentially increases passive income, resulting in a lifetime of financial freedom. However, the time it will take to achieve financial freedom is greatly affected by the stocks you choose. To read more about turbocharging your portfolio and making the journey faster, proceed to the Our Process tab.